Why “Waiting for the Market to Crash” Is Costing You More Than You Think

Every cycle, there’s a group of buyers and investors who swear they’re “waiting for the crash.”

They watch headlines.

They follow influencers.

They tell themselves they’ll jump in when prices finally fall.

And almost every time, they miss the window.

Not because they were wrong about risk—but because they misunderstood how real estate markets actually move.

The Myth of the Perfect Entry Point

Real estate doesn’t crash cleanly or conveniently.

By the time the news confirms a downturn:

-

Lending has already tightened

-

Inventory is picked over

-

Sellers with real motivation have already made deals

-

Fear has replaced opportunity

The best buying windows rarely feel obvious while they’re happening.

They feel uncomfortable.

They feel uncertain.

They feel like everyone else is waiting.

That’s usually the signal.

Markets Don’t Reward Certainty—They Reward Preparation

Most people don’t miss deals because prices didn’t drop enough.

They miss deals because:

-

They didn’t have financing lined up

-

They weren’t clear on their buy box

-

They hadn’t run enough numbers to recognize a good deal

-

They were emotionally anchored to yesterday’s prices

Smart investors and buyers don’t wait for certainty.

They wait for asymmetry—where risk and reward are mispriced.

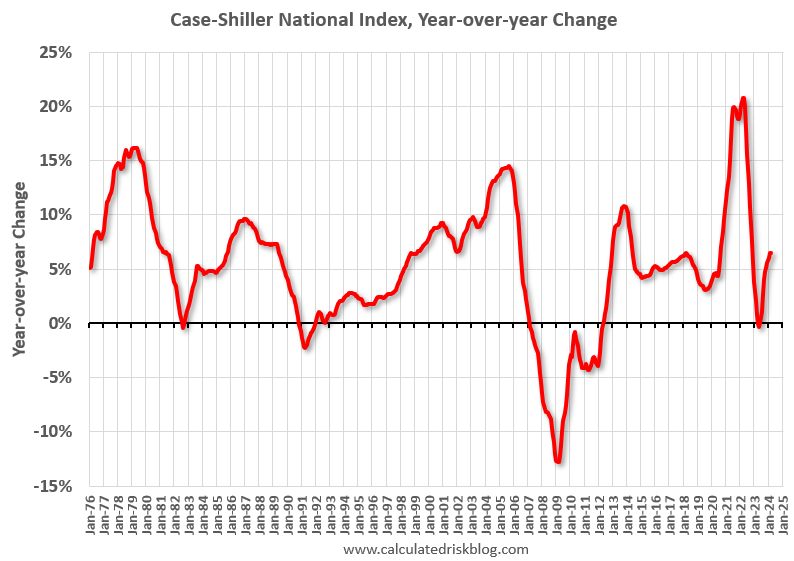

The Real Cost of Waiting

Waiting feels safe, but it has a hidden price tag.

Here’s what often happens while people sit on the sidelines:

-

Rents continue to rise

-

Rates move before prices adjust

-

Competition quietly returns

-

Equity opportunities compound for those already in

Even a “bad” deal done conservatively can outperform perfect timing that never comes.

Time in the market beats timing the market—especially in real estate, where leverage, tax treatment, and forced appreciation matter.

What Smart Buyers Are Doing Instead

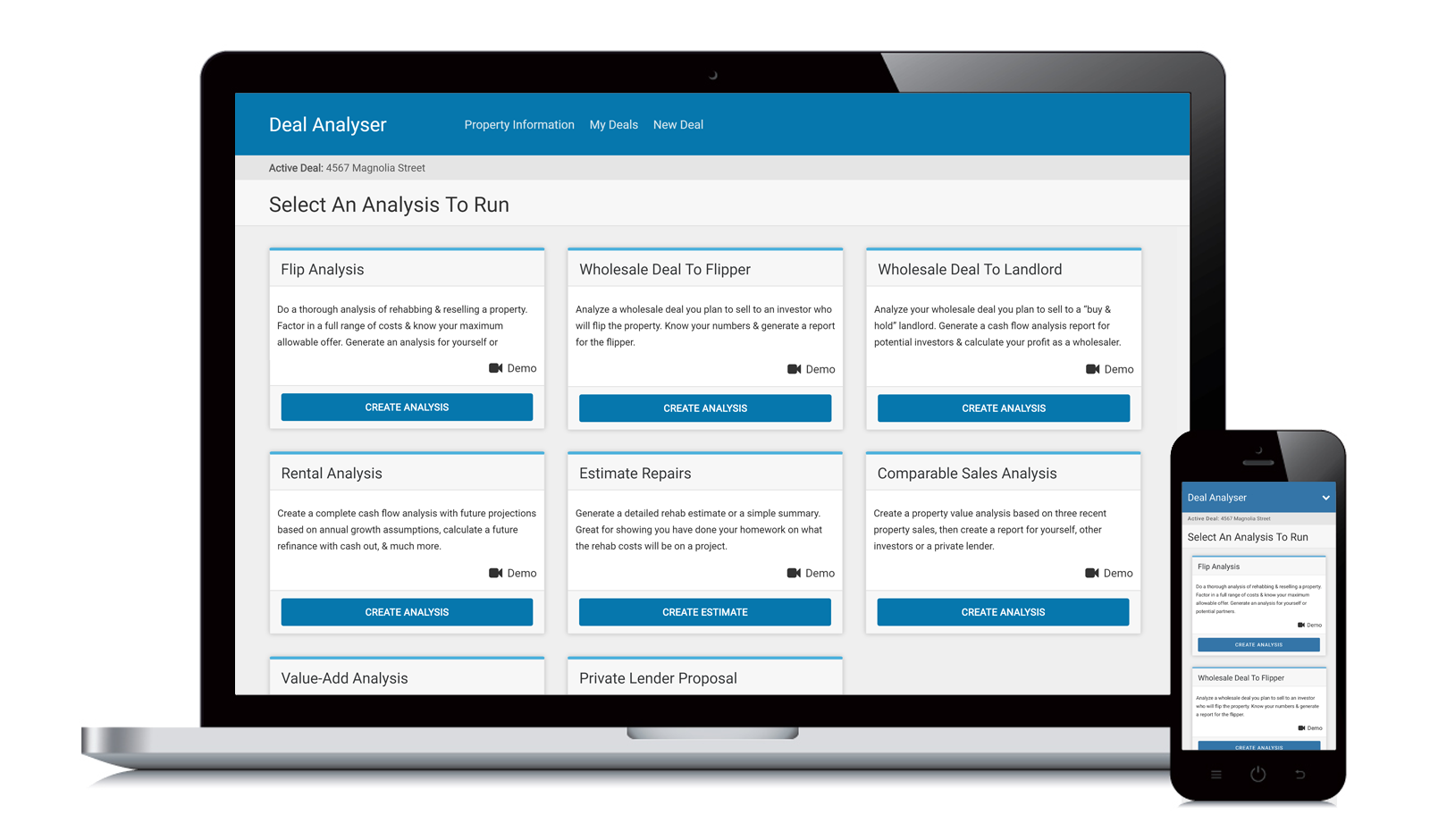

Rather than waiting for headlines to tell them it’s safe, experienced buyers focus on control:

-

Buying with margin, not hype

-

Structuring deals conservatively

-

Stress-testing payments and exit strategies

-

Using multiple financing options instead of one rigid plan

-

Letting numbers—not emotions—drive decisions

They don’t need the market to crash.

They just need deals that make sense today.

Final Thought

If your plan depends on a perfect crash, perfect rates, and perfect clarity—you don’t have a plan.

You have a delay strategy.

The buyers and investors who win long term aren’t reckless.

They’re prepared, flexible, and decisive when opportunity shows up quietly.

And by the time everyone agrees it’s safe again, the best opportunities are already gone.