Refinancing in 2026: How to Know If It Actually Makes Sense (Not Just a Lower Payment)

Refinancing gets marketed as a simple win: “Lower your rate, save money.”

But in the real world, that shortcut thinking is how people reset their loan clock, rack up extra interest, and wonder why their balance barely moves years later.

If you’re considering a refinance in 2026, here’s the framework that actually matters—no hype, no rate-watch clickbait.

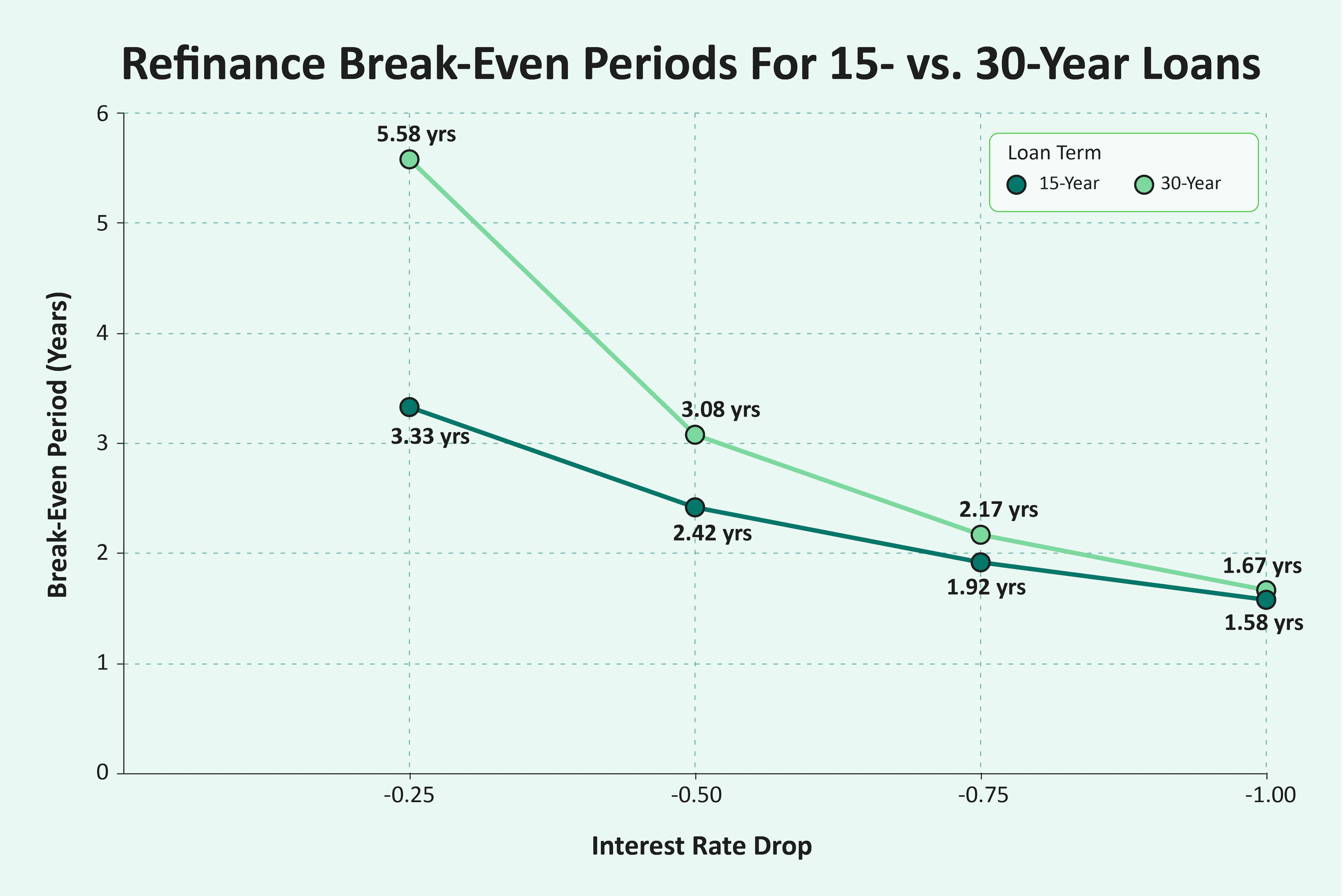

1. Start With the Breakeven, Not the Payment

A lower payment means nothing if it takes too long to recover the cost of the refinance.

Breakeven = Total loan costs ÷ Monthly savings

Example:

-

Total refi cost: $6,000

-

Monthly savings: $150

-

Breakeven: 40 months (~3.3 years)

Rule of thumb:

If your breakeven is longer than 24–36 months, you should pause. That’s the window where refis usually stop making financial sense unless there’s a bigger strategic reason.

2. “No Out-of-Pocket” Still Means You’re Paying

Rolling costs into the loan feels painless—but it’s not free.

When you finance closing costs:

-

Your loan balance increases

-

You pay interest on those costs

-

The true cost compounds over time

A refi that “costs nothing today” can easily add tens of thousands in long-term interest if you’re not careful.

3. Protect Your Remaining Loan Term (This Is Huge)

This is where most homeowners get smoked.

If you’re 7 years into a 30-year mortgage and refinance back into a new 30:

-

You just added 7 extra years of interest

-

Even at a lower rate, total interest can go up, not down

Smarter move:

Use a flex-term refinance:

-

If you have 23 years left → refi into a 23-year loan

-

Keep your payoff date intact

-

Still capture the rate improvement

This single adjustment often saves more money than chasing the absolute lowest rate.

4. Short-Term vs. Long-Term Savings (You Need Both)

A proper refinance analysis looks at two timelines:

Short-Term

-

Monthly payment change

-

Skipped payment(s)

-

Escrow refund applied strategically

Long-Term

-

Total interest paid over the life of the loan

-

Loan payoff date

-

Net savings after breakeven

If the refi only helps this year but hurts you over 10–20 years, it’s not a win.

5. When Refinancing Does Make Sense in 2026

Refinancing can be smart if:

-

Your breakeven is under 2–3 years

-

You keep (or shorten) your remaining term

-

You’re eliminating risky debt or bad loan structure

-

You’re improving both cash flow and total interest

It usually doesn’t make sense if:

-

The savings are minimal

-

The term resets unnecessarily

-

The decision is based purely on headlines or rate drops

The Bottom Line

Refinancing isn’t about chasing the lowest rate—it’s about making the math work in your favor.

The right refi:

-

Pays for itself quickly

-

Doesn’t extend your debt timeline

-

Improves your long-term position, not just your monthly payment

If you’re evaluating options and want a real breakdown—not a sales pitch—get the numbers side-by-side and look beyond the payment. That’s where the truth always shows up.