Should You Refinance When Rates Drop? Here’s the Math That Actually Matters

Every time rates dip, the same headlines show up:

“Now is the time to refinance.”

And every time, homeowners ask the same question:

“Should I refinance now, or wait?”

Here’s the truth most lenders won’t say out loud:

A refinance is not automatically smart just because rates dropped.

What matters is the math — and how the refinance fits into your long-term plan.

Let’s break it down in plain English.

The #1 Mistake People Make With Refinancing

Most people decide to refinance based on monthly payment savings alone.

That’s a mistake.

Yes, lowering your payment can help cash flow — but a refinance also:

-

Adds closing costs

-

Often resets your loan term

-

Can increase total interest paid over time

A lower payment does not automatically mean a better deal.

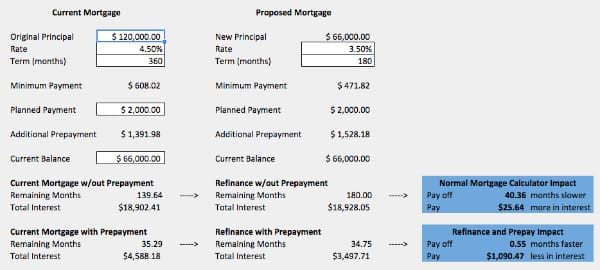

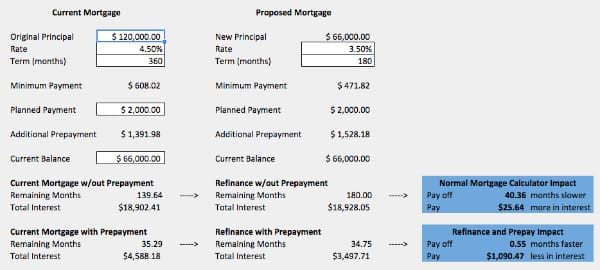

The Only Question That Actually Matters: Breakeven

Before refinancing, you need to know your recoup (breakeven) period.

That’s simply:

Closing costs ÷ monthly savings = months to break even

Example:

-

Closing costs: $6,000

-

Monthly savings: $200

-

Breakeven: 30 months (2.5 years)

If you sell or refinance again before that point, the refi didn’t really help you.

As a general rule:

-

Under 24–36 months → worth serious consideration

-

Over 36 months → usually not worth it unless there’s another benefit

“No Out-of-Pocket” Doesn’t Mean Free

You’ve probably heard:

“There are no out-of-pocket costs.”

True — but misleading.

Those costs are usually:

-

Rolled into the loan balance, or

-

Covered by a higher rate

Either way, you’re still paying for them, just over time instead of upfront.

That’s why you always want to look at:

-

Total loan balance after refinance

-

Total interest paid over the life of the loan

Not just the new monthly payment.

Watch Out for Term Resets

This one gets people burned.

If you’re 7 years into a 30-year loan and refinance into a new 30-year loan, you just restarted the clock.

That can:

-

Lower your payment

-

Increase lifetime interest by tens or hundreds of thousands

A smarter strategy is often a flex-term option:

-

22-year fixed

-

23-year fixed

-

Or keeping the same payoff timeline

Lower rate without extending the debt.

When Refinancing Does Make Sense

A refinance can be a great move when it does at least one of the following:

-

Shortens your breakeven period

-

Keeps (or shortens) your remaining loan term

-

Removes mortgage insurance

-

Converts risky debt (credit cards, HELOCs) into structured, lower-rate debt

-

Improves both monthly cash flow and long-term interest

If it only solves one short-term problem and creates a long-term one, pause.

What About FHA and VA Loans?

Programs like Federal Housing Administration and Department of Veterans Affairs offer streamline refinance options that can be powerful — but they still follow the same rules:

-

There are still costs

-

There is still a breakeven

-

There can still be term resets

Streamlined doesn’t mean “don’t do the math.”

The Right Way to Decide

Before refinancing, you should always review:

-

Monthly savings

-

Closing costs (real numbers, not estimates)

-

Breakeven timeline

-

Remaining term vs. new term

-

Total interest paid comparison

A refinance should improve both your short-term and long-term position — not just one.

Final Thought

Rates going down is just one input, not the decision.

The best refinance is the one that fits your plan:

-

How long you’ll keep the home

-

Whether you plan to move, rent, or refinance again

-

Your cash flow goals vs. total cost goals