Why Most Real Estate Investors Fail (And It Has Nothing to Do With the Market)

If you spend enough time online, you’ll hear the same excuses over and over:

-

“Rates are too high.”

-

“Deals don’t pencil anymore.”

-

“The market is about to crash.”

-

“I’m just waiting for the right time.”

None of those are the real reason most investors fail.

The uncomfortable truth is this: most real estate investors fail because they never build a real operating system.

They chase tactics instead of execution.

The Real Problem: Hobby Investors vs. Operators

Most people approach real estate like a side hobby.

They:

-

Watch YouTube videos

-

Scroll Instagram reels

-

Analyze deals “in theory”

-

Talk about what they would buy

But they never commit to a repeatable process.

Real estate rewards operators, not spectators.

Operators have:

-

Clear buying criteria

-

Defined deal funnels

-

Capital sources lined up

-

A plan for when things go wrong

Hobby investors just hope the deal works out.

Hope is not a strategy.

Why Market Conditions Don’t Matter as Much as You Think

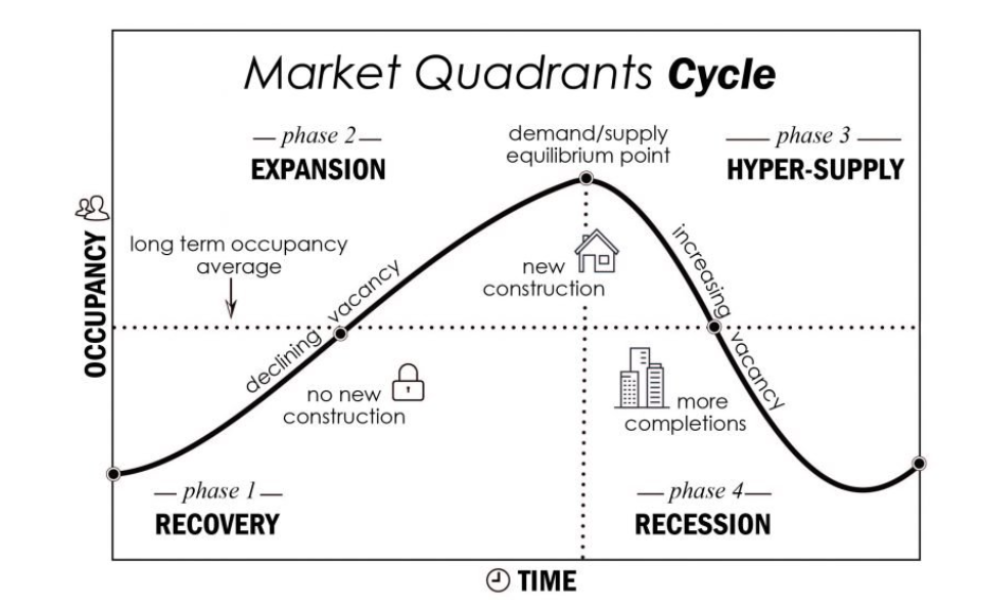

Every market cycle creates winners.

High rates?

-

Less competition

-

More motivated sellers

-

Better terms if you know how to structure deals

Low inventory?

-

Creative financing

-

Off-market deals

-

Value-add strategies

Uncertainty doesn’t kill investors. Indecision does.

The best operators adapt. Everyone else waits—and waiting is how you get left behind.

The Execution Gap Nobody Talks About

Here’s where most investors get stuck:

They know what to do—but not how to do it consistently.

They don’t have:

-

A daily lead-generation habit

-

Follow-up systems

-

Deal analysis standards

-

Capital conversations happening before they need the money

So when a real opportunity shows up, they’re unprepared.

And unprepared investors hesitate.

Hesitation kills deals.

Cash Flow, Appreciation, or Control—Pick Two

Another silent killer is confusion.

Too many investors chase everything at once:

-

Cash flow

-

Appreciation

-

Tax benefits

-

BRRRRs

-

Flips

-

Short-term rentals

But great investors are brutally clear.

They know:

-

What type of deal they are buying

-

Why they are buying it

-

What success looks like before they close

Clarity creates speed.

Speed creates leverage.

Why Simple Beats Smart Every Time

The most successful investors I know don’t do complicated deals.

They do:

-

Boring math

-

Conservative underwriting

-

Simple renovations

-

Clear exits

Over and over again.

They don’t try to impress people on social media.

They try to build durable wealth.

Simple scales.

Complex breaks.

The Shift That Changes Everything

If you want to stop spinning your wheels, make this shift:

Stop asking:

“Is this the perfect deal?”

Start asking:

“Does this fit my system?”

Systems remove emotion.

Systems create momentum.

Systems keep you investing when everyone else freezes.

Final Thought

Most real estate investors don’t fail because they picked the wrong market.

They fail because they never committed to becoming operators.

If you build the system, the deals follow.

If you chase deals without a system, burnout follows.

The market will always change.

Execution is what separates the survivors from the spectators.